2021 predictions for mortgage lending

Total home sales will increase 5.7% this year over 2019, to 6.37 million units on a seasonally adjusted annual rate basis, Fannie Mae said. That will be driven by a 21.5% increase in new-home sales. Existing-home sales will be up 3.6% on a year-over-year basis.

While total home sales are expected to increase by 0.8% next year, new-home sales will be up by 6.2% while existing-home sales should remain flat in Fannie Mae’s forecast.

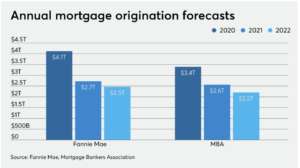

The forecasts for 2022 and 2023 were also raised to $2.2 trillion and $2.17 trillion, respectively.

While Fratantoni’s total forecast remains conservative compared with Duncan’s, he also boosted his prior prediction for record purchase activity over the next three years. The MBA expects 2020 to end with $1.42 trillion in purchase volume. That will increase to $1.59 trillion next year, then to $1.63 trillion in 2022 and $1.65 trillion in 2023.

“You’ve got re-verification turnarounds that are super fast, and you’ve got a lot of potential for human error,” Gauthier added. “Not to mention the different processes to handle these purchases because they are at home, with your processor, underwriter and closer handling different bits of that process.”

However, given how hard the private-label mortgage-backed securities market was hit at the onset of the pandemic, there is little expectation that the market will grow by much in the next year.

“The private label MBS market is not currently viewed as likely to be more robust than it is today,” said Tim Rood, head of government and industry relations at SitusAMC.